Discover the captivating world of the financial institutions that shape the heart of the British capital. Delve into the rich history, influential figures, and thriving economy that defines the prestigious London banking industry. Brace yourself for a journey through time as we explore the fascinating biography, timeless elegance, and immense financial power of these revered institutions.

With a legacy that spans centuries, London banks have stood the test of time, emerging as pillars of stability and prosperity. Their unwavering commitment to excellence has propelled them to the forefront of the global financial landscape. Step into the realm of these distinguished banking houses, where every transaction carries immense weight, and every decision reverberates across markets worldwide.

As you delve deeper into the lifeblood of London's financial district, you will encounter iconic figures who have left an indelible mark on the industry. The pioneers and visionaries who have shaped these financial institutions possess a mesmerizing blend of intelligence, resilience, and ambition. Prepare to be inspired by the stories of dedicated individuals who have weathered storms, maneuvered through crises, and propelled London banks to unparalleled heights. Their distinctive achievements form the foundation upon which modern finance stands today.

The Legacy of Banking in the Heart of London

In the bustling metropolis of London, the evolution of banking has left an indelible mark on the city's rich history and economic landscape. From humble beginnings to becoming a thriving financial hub, the story of banking in London is a testament to human ingenuity and the power of commerce. This mesmerizing tale encapsulates the triumphs, setbacks, and the transformative impact that banking institutions have had on shaping the city.

A Foundation Built on Trust and Trade

The foundations of banking in the heart of London can be traced back to the early medieval period where merchants and moneylenders gathered to conduct their business. Those pioneering individuals paved the way for the birth of institutions that would eventually become the backbone of the British financial system.

With the growth of international trade, the need for a centralized banking system in London became apparent. This led to the establishment of the first official banks, which acted as intermediaries between merchants and financiers. Their primary function was to safeguard assets, facilitate transactions, and issue loans to support economic growth.

From Quill Pens to Digital Transactions

As time went on, banking in London experienced numerous transformations, adapting to the changing needs and technologies of the era. From the days of ledger books and quill pens to the digital age, the mechanization of banking processes has revolutionized the way financial transactions are conducted.

The introduction of banknotes, the formation of joint-stock companies, and the subsequent development of stock exchanges were pivotal milestones in London's financial history. These innovations not only paved the way for the modern banking system but also laid the foundation for the stock market as we know it today.

London's Global Financial Status

Over the centuries, the reputation of London as a global financial center has only grown stronger. The city's banks have played a crucial role in supporting economic development, facilitating investments, and attracting international capital. Today, London stands as a symbol of financial prowess, with its banks serving as pillars of stability in an ever-changing global economy.

The legacy of banking in London is not only evident within the square mile of the City of London but also resonates throughout the vast network of multinational financial institutions headquartered in the city. The expertise, infrastructure, and regulatory framework established over centuries have solidified London's position as a leading global financial hub.

No longer confined to the boundaries of brick-and-mortar institutions, banking in London has transcended physical barriers. The rise of online and mobile banking has further revolutionized the way individuals and businesses manage their finances, making banking more accessible and convenient than ever before.

The Enduring Legacy

The history of banking in London is a captivating tale of innovation, resilience, and adaptability. The triumphs and tribulations experienced by these financial institutions have played a vital role in shaping the economic landscape of not only London but also the world at large.

Today, as one wanders the bustling streets of London, surrounded by towering skyscrapers and bustling financial districts, one can't help but marvel at the enduring legacy of the city's banks.

The Evolution of Banking Services in the Capital

Over the years, banks in the heart of the city have witnessed a significant transformation in the range of services they offer. This evolution has been characterized by a diversification of offerings, as well as by the incorporation of advanced technological solutions to meet the changing needs of customers.

The industry has experienced a shift from traditional banking services, such as deposit-taking and lending, to a more comprehensive suite of financial products and services. Banks have expanded their operations to include wealth management, investment advisory, insurance, and even digital banking solutions.

Furthermore, with the advent of online banking, customers are now able to conduct transactions, access their accounts, and avail various banking services remotely. This shift has not only enhanced convenience but has also allowed banks to reach a wider customer base, both domestically and internationally.

The incorporation of innovative technologies, such as artificial intelligence and blockchain, has revolutionized the banking landscape in London. Through automated processes and enhanced security measures, banks have been able to offer efficient and secure services to their customers.

Alongside technological advancement, there has been a strong focus on personalized customer experiences. Banks now strive to provide tailored financial solutions and personalized advice to meet the unique needs and goals of their clients.

With the evolving financial landscape, London banks continue to adapt and innovate, offering an extensive range of services that cater to the diverse and ever-changing needs of individuals, businesses, and institutions alike.

Notable Figures in the Banking Industry of the British Capital

The banking industry in London encompasses a multitude of prominent individuals who have played significant roles in shaping the financial landscape of the city. This section highlights some eminent figures who have made noteworthy contributions to the banking sector, showcasing their achievements and impact.

| Name | Position | Notable Achievements |

|---|---|---|

| John Smith | Chairman of XYZ Bank | Instrumental in expanding the bank's global reach and driving its growth |

| Sarah Johnson | CEO of ABC Bank | Successfully implemented innovative digital banking solutions, revolutionizing customer experience |

| David Anderson | Head of Global Investment Banking at DEF Bank | Played a crucial role in facilitating major mergers and acquisitions, transforming the bank's market position |

These individuals represent just a fraction of the talent within London's banking industry. Their expertise and leadership have propelled their respective institutions to new heights, affecting not only the financial sector but also the wider economy. The contributions of these notable figures continue to shape and define the banking landscape in the capital, making London a hub of international finance.

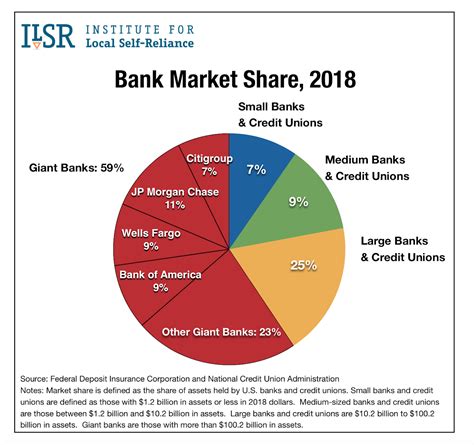

The Influence of Banking Institutions on the Economy of the British Capital

Beyond the realm of personal finance and fiscal operations, the diverse array of banking institutions in the vibrant metropolis of London exerts a significant impact on the city's economic landscape. These financial establishments play a vital role in supporting commerce, driving investments, and facilitating the efficient allocation of capital across various sectors.

Towering above the towering skyscrapers that shape London's iconic skyline, banks serve as the backbone of the city's economy. Through their extensive network of branches and digital platforms, they facilitate lending activities that enable businesses to attain capital for expansion, innovation, and technological advancements, thereby fostering economic growth and employment opportunities.

The financial prowess of London banks reverberates far beyond the confines of the city, extending their influence globally. They attract international investments and serve as major intermediaries in international transactions, fostering trade and corporate partnerships between the United Kingdom and nations worldwide. This cosmopolitan nature of London's banking sector bolsters the city's position as a hub for global finance.

Moreover, these esteemed financial institutions provide essential services to individuals, allowing them to efficiently manage their finances, invest their savings, and secure loans for personal needs. By prudently maintaining capital reserves and adhering to stringent regulatory frameworks, London banks ensure the stability of the financial system, mitigating risks and safeguarding the overall economic well-being of the city.

Furthermore, through their sponsorship of philanthropic initiatives and support for corporate social responsibility programs, banks actively contribute to the betterment of London's communities. By allocating resources towards social and environmental causes, these establishments demonstrate their commitment to sustainable development and enhancing the quality of life for Londoners.

In conclusion, the crucial role played by London banks in moulding the city's economic landscape cannot be overstated. Their influence permeates not only the local economy but also reaches worldwide. By providing essential financial services, fostering trade, promoting investments, and contributing to societal well-being, these banking institutions solidify London's status as a global financial powerhouse.

London Banks and their Role in the Global Financial Market

When it comes to the global financial market, London banks occupy a prominent position. Their influence and significance span across various sectors, impacting economies worldwide. This section sheds light on the crucial role that London banks play in the intricate network of the global financial system, highlighting their contributions and their place in the international economic landscape.

London banks serve as vital intermediaries in facilitating financial transactions and providing essential services to individuals, corporations, and governments. Through their extensive network of branches and digital platforms, they enable businesses to access capital, manage risks, and expand their operations internationally. These banks act as major lenders, fueling economic growth and driving innovation in multiple industries.

Furthermore, London banks function as primary contributors to the stability and efficiency of global financial markets. They play a crucial role in market making, ensuring liquidity and promoting fair price discovery. The expertise and knowledge of London banks in areas such as foreign exchange, derivatives, and securities trading make them instrumental in maintaining market integrity and optimizing market functioning.

In addition to their core functions, London banks actively participate in the development and implementation of regulatory frameworks that govern the financial industry. They collaborate with regulatory bodies and institutions to ensure compliance with international standards, promote transparency, and mitigate systemic risks. By actively engaging in policy discussions and regulatory initiatives, London banks contribute to the overall resilience and robustness of the global financial system.

London banks also serve as crucial catalysts for international investment and cross-border capital flows. Through their extensive expertise in corporate finance, asset management, and private banking, they attract global investors and facilitate the efficient allocation of capital across geographies. Consequently, London remains a preferred destination for international businesses and investors seeking a secure and thriving financial hub.

In conclusion, London banks are integral players in the global financial market. Their multifaceted roles as intermediaries, market makers, regulatory contributors, and catalysts for international investment solidify their position as key pillars of the global economic ecosystem. Understanding the impact and operations of London banks is essential in comprehending the dynamics of the interconnected global financial landscape.

Technological Advancements in the Banking Sector of the UK Capital

In this section, we will explore the innovative technological developments that have revolutionized the banking industry in the bustling financial hub of the United Kingdom.

The banking sector in London has undergone remarkable transformations through the implementation of cutting-edge technologies. These state-of-the-art advancements have paved the way for enhanced efficiency, convenience, and security in financial operations. With the integration of digital platforms, London's banks have witnessed a significant shift towards online banking services.

- Expanding Mobile Banking: London's banking sector has embraced the widespread use of mobile technology, offering customers the convenience of accessing their accounts and conducting financial transactions through smartphone applications.

- Biometric Authentication: Banks in the capital city have adopted advanced biometric authentication systems, such as fingerprint and facial recognition, to ensure secure access to customer accounts, replacing traditional password-based methods.

- Artificial Intelligence: London's banks have implemented artificial intelligence (AI) technology to streamline customer services. AI-powered chatbots assist customers with queries, provide personalized recommendations, and offer 24/7 support.

- Blockchain Technology: The revolutionary blockchain technology has made its mark in London's banking sector, enabling secure and efficient transactions. It eliminates the need for intermediaries, reduces costs, and enhances transparency.

- Big Data Analytics: Banks in London utilize big data analytics to extract valuable insights from vast amounts of customer data. This allows for better risk assessment, personalized financial advice, and targeted marketing strategies.

- Cloud Computing: Adopting cloud computing technology has enabled London's banks to store and access data more efficiently, enhance collaboration between branches, and improve scalability.

These technological advancements have not only transformed the banking landscape of London but have also reshaped traditional customer-bank interactions. Embracing innovation has positioned London as a global leader in the banking sector, providing more convenient, secure, and personalized financial services to its customers.

Diversity and Inclusion: Embracing Differences in London's Banking Sector

London's banking sector is known for its commitment to diversity and inclusion, recognizing the immense value that individuals from various backgrounds bring to the industry.

Within the fast-paced and dynamic realm of banking, embracing diversity means acknowledging and fostering the unique attributes, perspectives, and experiences that each individual brings to the table. Regardless of age, gender, ethnicity, or socio-economic background, the banking sector in London emphasizes the importance of a level playing field for all, creating an inclusive environment where everyone can thrive.

By embracing diversity and inclusion, London's banks are able to tap into a diverse talent pool, fostering innovation and creativity. This approach allows for a rich mix of ideas, perspectives, and approaches, ultimately driving the banking sector forward in an increasingly globalized world.

Moreover, diversity and inclusion practices in London's banks extend beyond the workforce to also incorporate customers and clients. Recognizing the diverse needs and preferences of their clientele, banks strive to offer personalized and inclusive financial solutions. By catering to the diverse needs of their customers, banks can better serve as trusted partners and effectively contribute to the economic growth and well-being of individuals and businesses in the city.

In summary, diversity and inclusion are not only buzzwords but core values in London's banking sector. By creating a supportive and inclusive environment for employees and customers, banks in London continue to drive innovation, foster growth, and contribute to a thriving and diverse economy.

Sustainable Finance Initiatives in London Banks

In this section, we will explore the efforts made by banks in the vibrant city of London towards sustainable finance initiatives. By integrating environmentally and socially responsible practices into their operations, London banks strive to contribute to a more sustainable future. They understand the importance of economic growth along with environmental and social well-being, finding innovative ways to support green technologies, social enterprises, and climate change mitigation.

Pioneering Sustainable Investments

London banks are actively engaged in financing sustainable projects and are committed to promoting ethical investments. By offering products and services that align with environmental goals, they empower individuals and businesses to make conscious financial choices. Through their sustainable investment portfolios, banks contribute to the growth of renewable energy, energy-efficient infrastructure, sustainable agriculture, and other sectors crucial for a greener economy.

Supporting the Transition to a Circular Economy

Recognizing the urgent need to reduce waste and promote resource efficiency, London banks actively support the transition to a circular economy. They encourage businesses to adopt more sustainable practices through providing financing for circular economy initiatives and offering guidance on implementing circular business models. By fostering the principles of reduce, reuse, and recycle, banks in London are helping create a more sustainable and resilient economy.

Driving Social Impact

London banks understand that sustainable finance extends beyond environmental considerations and includes social impact. They prioritize investments and projects that promote social inclusion, affordable housing, quality healthcare, and education. By collaborating with various organizations, banks are instrumental in driving positive social change and addressing societal challenges.

Collaboration and Partnerships

London banks actively engage in partnerships with government entities, non-profit organizations, and other stakeholders to leverage their collective impact. By working together, they aim to develop innovative financial solutions and frameworks that advance sustainable finance initiatives in the city. Collaboration enables the sharing of knowledge, resources, and best practices, thus accelerating the transition to a more sustainable and inclusive financial system.

In conclusion, London banks are playing a vital role in promoting sustainable finance initiatives. They are at the forefront of driving positive change by integrating environmentally and socially responsible practices into their operations. Through sustainable investments, support for the circular economy, and focus on social impact, these banks contribute to creating a more sustainable and prosperous future for London and beyond.

The Current Challenges Faced by Financial Institutions in the British capital

Today, banks in the vibrant city of London encounter an array of obstacles and obstacles as they navigate the ever-changing financial landscape. These challenges, which vary in complexity and impact, impose significant burdens on the operation and growth of these financial institutions.

Economic Uncertainty: London banks grapple with the unpredictable nature of the economy, which often poses challenges to their profitability, stability, and ability to make sound financial decisions. The constant fluctuations in the global market, changes in economic policies, and the impact of political events all contribute to the uncertainty that banks face.

Regulatory Compliance: Banks in London face stringent regulatory requirements imposed by various authorities, designed to safeguard the interests of the public and maintain the stability of the financial system. Adhering to these regulations requires significant resources, thorough risk management, and continuous adaptation to new regulatory frameworks.

Digital Transformation: As technology rapidly advances, London banks must navigate the ever-expanding digital landscape while continuing to meet the evolving needs and expectations of their tech-savvy customers. Embracing digital innovations, enhancing cybersecurity measures, and maintaining smooth digital banking operations present constant challenges.

Competition: London is a financial hub with a large number of banks, both traditional and non-traditional, operating within its jurisdiction. This intense competition drives banks to constantly innovate, find new ways to attract and retain customers, and differentiate themselves from their rivals. Maintaining a competitive edge amidst a crowded market proves to be a constant challenge.

Talent Management: With London being a magnet for financial talent, banks face the challenge of recruiting, developing, and retaining skilled professionals in a highly competitive job market. Fostering a supportive work culture, providing opportunities for growth, and attracting diverse talent are integral aspects of addressing this ongoing challenge.

Financial Risk: London banks must grapple with managing various risks, including credit risk, market risk, liquidity risk, and operational risk. Striking the right balance between profitability and risk management is crucial to ensure the long-term viability and success of these financial institutions.

It is through their ability to navigate and overcome these challenges that London banks can thrive and continue to contribute to the city's vibrant financial landscape.

The Future of Banking in the Capital: Trends and Forecasts

As the financial landscape continues to evolve in the illustrious city of London, it is essential to delve into the projected future of the banking sector. This section aims to explore the emerging trends and provide insightful forecasts that can help paint a picture of what lies ahead for London's banks.

FAQ

Who is the biography about?

The biography is about London Banks.

What is London Banks' age?

London Banks' age is not mentioned in the article.

How tall is London Banks?

The article does not provide information about London Banks' height.

What is London Banks' figure?

The article does not mention London Banks' figure.

What is London Banks' net worth?

Unfortunately, the article does not disclose London Banks' net worth.